2025 Year in Review

2025 unfolded against a backdrop of heightened geopolitical tensions, shifting central bank policy, and uneven global growth. Markets began the year cautiously, with Donald Trump’s return to the US presidency renewing tariff uncertainty and contributing to early volatility as investors assessed potential impacts on trade, inflation and corporate earnings. Confidence gradually improved as inflation moderated across major economies and expectations for steadier policy settings emerged. A powerful theme in markets was the accelerated investment in artificial intelligence, which became a central driver of global market leadership as the year progressed.

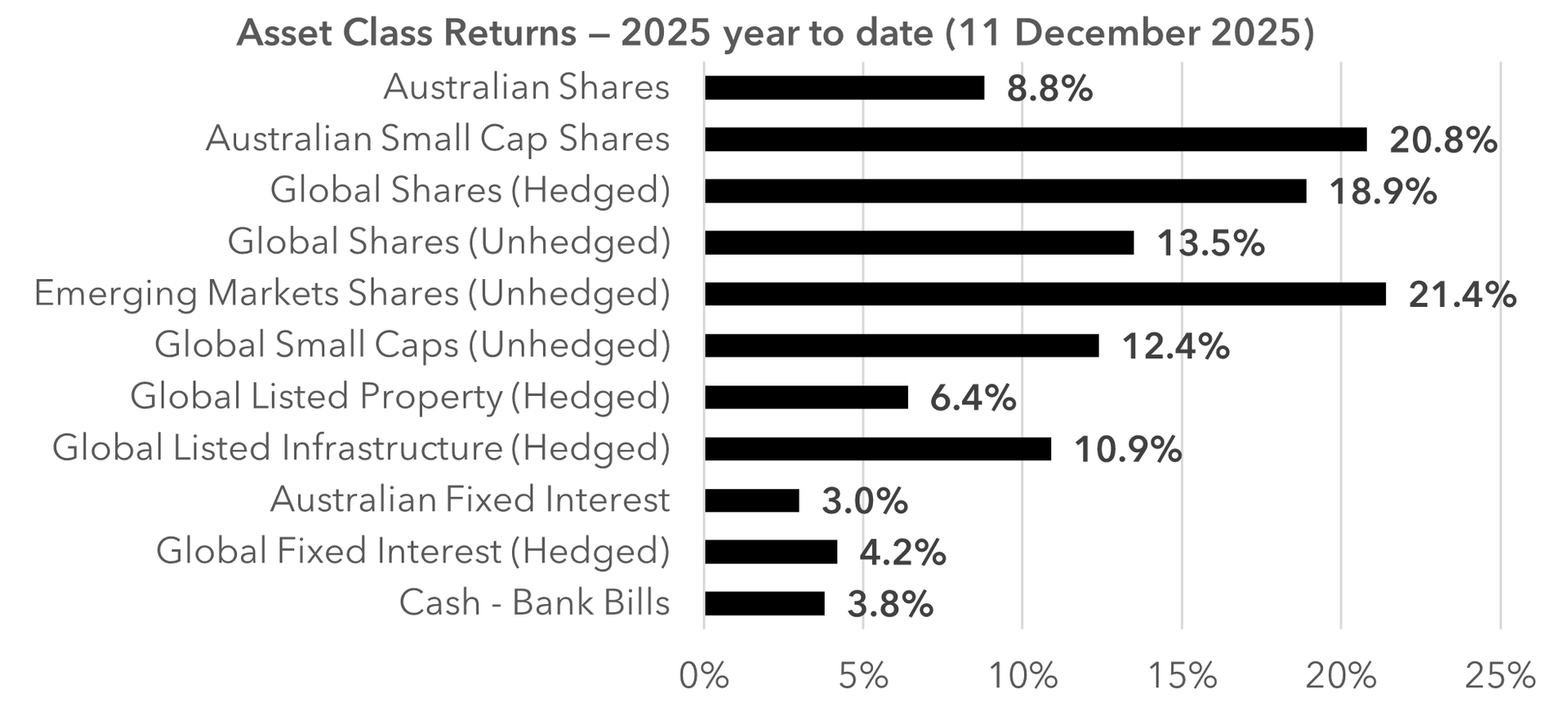

US mega-cap technology companies dominated global returns, contributing to strong performance for the US market. Europe and Japan also delivered solid gains, supported in Europe by easing inflation pressures and resilient corporate earnings, and in Japan by continued structural reforms and improving profitability. Emerging markets outperformed developed markets over the year, driven largely by strong gains in China, where supportive policy measures and stabilising economic data helped lift investor confidence.

Australian shares delivered strong results but lagged global peers, reflecting a narrower set of market drivers and domestic headwinds. Materials supported the local index, aided by strong commodity prices, with a notable share of small-cap gains coming from resource companies, particularly gold miners, benefiting from the rally in gold. However, weakness in health care due to tariff related policy uncertainty and softer performance from the banks weighed on returns. The market also remained more sensitive to shifting inflation expectations and uncertainty around the RBA’s policy path, which tempered valuation expansion compared with overseas markets.

Fixed interest markets provided stability through 2025, with bond yields reflecting the balance among moderating inflation, slower global growth and central bank policy. US Treasury yields declined over the year, helping global bond markets deliver positive returns, while Australian government bond yields rose as local inflation proved more persistent. Australian fixed interest delivered solid outcomes, supported by the higher-yield environment. Credit markets performed well across regions, with Australian and global credit generating steady gains, and global high yield recording strong results.